The best Corona Virus investing advice: Stay Put

One of the biggest reasons you need a relationship with an appropriately experienced and qualified financial advisor is to help you avoid the most common, and potentially devastating, mistake people make once they actually retire. I call this mistake the ‘Timing Fallacy’. Many people are making it right now, in the wake of the COVID-19 (or more commonly known as: Coronavirus) pandemic.

The Timing Fallacy works like this. You reach retirement age. Congratulations! You have a retirement strategy You know you want that strategy to continue to perform for you in a certain way, so that you can live off your investments for a number of years. Who wouldn’t want that? You imagine that your job is to master the ‘timing’ of the market, so as to benefit most from good times and protect yourself from the reverse in bad times, and that seems to make perfect sense. So you buy and sell, buy and sell, buy and sell, based on whatever emotions happen to be driving the market at any given moment.

And as a result, you destroy your portfolio’s potential to generate the return you want.

This brings us to one of my favourite quotes from any investment specialist. Christopher Davis, of Davis investments, who said: ‘Though tempting, trying to time the market is a loser’s game. $10,000 continuously invested in the market over the past 20 years grew to more than $48,000. If you missed just the best 30 days, your investment was reduced to $9,900.’

The Oracle of Omaha, Warren Buffet, made the same point, but much more concisely, when he observed that ‘Money flows from the active to the patient.’

And he has built an extraordinary career out of being very patient!

I know that all of this sounds counterintuitive when the market is dropping, as it is right now. And I know it seems like you should be able to protect your retirement strategy by mastering the ‘timing’ of the market and finding a way to profit from its various gyrations. But the reality is that what matters for most people (including yours truly) is not the timing ... it’s the ‘time IN’ the market.

Put in the simplest of terms, it is our ability to stick with intelligently chosen investment strategy over the long haul that matters.

Peter Lynch, formerly of Magellan, once observed that the list of qualities a successful investor should have include ‘patience, self-reliance, common sense, a tolerance for pain, open-mindedness, detachment, persistence, humility, flexibility, a willingness to do independent research, an equal willingness to admit mistakes, and the ability to ignore general panic.’ Well put! With that list of qualities in mind, consider the following true story about Debbie, who scores particularly high on the ‘ignore general panic’ scale.

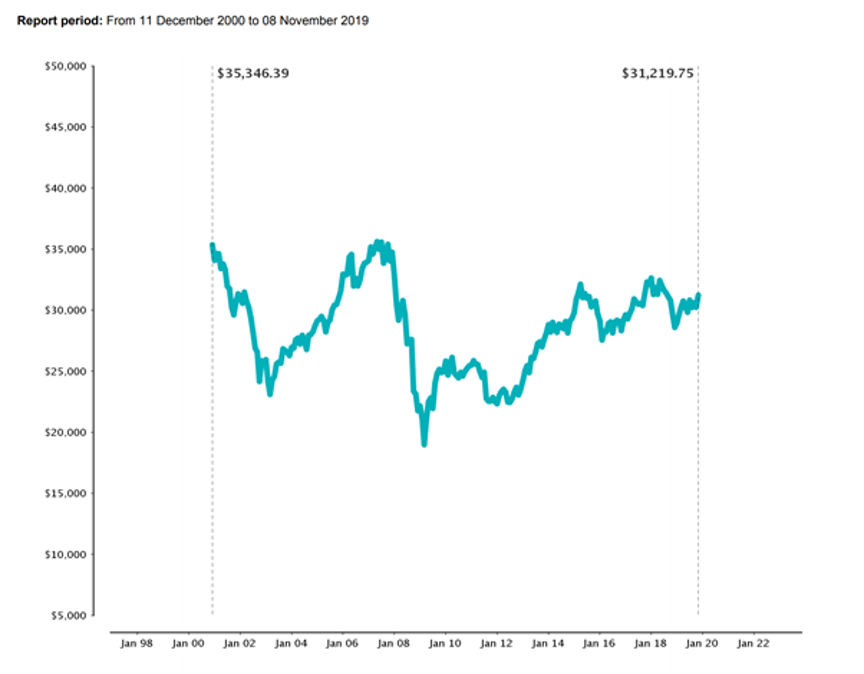

Fortunately for her, she had a financial advisor who helped her, many years ago, to set up a good retirement plan with a sound investment strategy. Debbie retired in the year 2000, when she turned 65. She’s been retired for two decades now. Because she has stuck to her plan, and because she has avoided the instinct to play the market, outsmart the market, or otherwise master the ‘timing’ of the market, here is how one of the investments in her portfolio performance looks like.

Yes, there were periods of market decline. But look what inevitably happened afterwards: steady market recovery. Debbie earned each of those recoveries … by sticking with the plan.

Part of Debbie’s plan was to have a plan! And that included only withdrawing pension payments for her daily living expenses. By accumulating a whole lot of uninterrupted time in the market by holding true to her unique needs, goals, and objectives. That’s how she protected herself.

When you think back on the period we’re talking about (late 2000 to late 2019), you realise that a whole lot has happened in the market, both from an emotional perspective and in terms of regulation/legislation, over the two decades Debbie has been counting on that portfolio to supplement her retirement cashflow. Not all of what has happened has been pretty.

To take only the three most obvious examples, there was a recession that started in March of 2001, a major terrorist attack on September 11 of that same year that panicked everyone, and a global financial crisis that led to a worldwide economic downturn starting in late 2007 and extending into mid-2009. There were a great many retired people who saw those things happening in the market and panicked. They considered current events and said to themselves, ‘The market is too risky, let’s put our money somewhere ‘safe’, like cash or certificates of deposit (or term deposits, in Aussie-speak), until things calm down’.

That’s what trying to ‘time the market’ usually sounds like. But it’s not safe. In fact it’s downright reckless.

Had Debbie tried to ‘time’ the market every time there was a flood of emotion, like the emotion coursing through the markets right now in response to the coronavirus pandemic, her portfolio would look a lot different today!

So here is my question. Which retirement strategy would you rather be able to point to after twenty or thirty years? The one where you stayed in the market? Or the one where you panicked and diminished both your capital and your earning power? Not a difficult choice, is it?

As we’ve said to many people over the last few weeks, we can’t control what crises the market experiences. That’s out of our hands. Some people have major market events, like the coronavirus pandemic, to deal with during their retirement. Others don’t. But if we have the right person in our corner, we can set up and follow through on a personally tailored financial plan that delivers, and protects, a safe retirement, no matter what the market comes up with.

With the help of an appropriately experienced and qualified financial advisor, you can do exactly what Debbie did. You can set up a personally tailored long-term plan, based on your unique needs, goals, and objectives. You can avoid the trap a lot of retirees fall into, of trying to ‘time’ your investment choices. You can stay put, maximize your time in the market, and minimize the amount of stress, drama, and crisis you have to deal with on a personal level.

And isn’t that what retirement is supposed to be all about?

Be well; stay safe (and stay home); and see you all next time 😊

Hari Maragos aka - The Advice Coach

(https://www.linkedin.com/in/harimaragos/)

Principal - Victoria Wealth Management Pty Ltd